800 am to 500 pm. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai.

Guide To E Filing Income Tax Malaysia Lhdn Youtube

15 th July 2014.

. Peak Hours at LHDNM Customer Service Centre 1-800-88-5436 LHDN. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. Lembaga Hasil Dalam Negeri Malaysia.

For individual e-filing PIN application via e-mail can be made using Customer Feedback Form. Produce critical tax reporting requirements faster and more accurately. Download a copy of the form and fill in your details.

To facilitate communication via our 1 300 88 3010 telephone service please be informed that our telephone service peak hours are from 0930am to 1230 pm and 200 pm to 430 pm daily. LHDN e-filing in Malaysia is the electronic method of filing Income Tax Return Forms ITRFs via the internet. In 2001 the tax policy was changed from the.

Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia. Form E will only be considered complete if CP8D is submitted within the stipulated deadline. Import Your Tax Forms And File For Your Max Refund Today.

Please be informed. Below is the guide to step-by-step on how to register LHDN Employer Tax. Before this I have asked my colleague they said have to go to the LHDN office and request online request is not working.

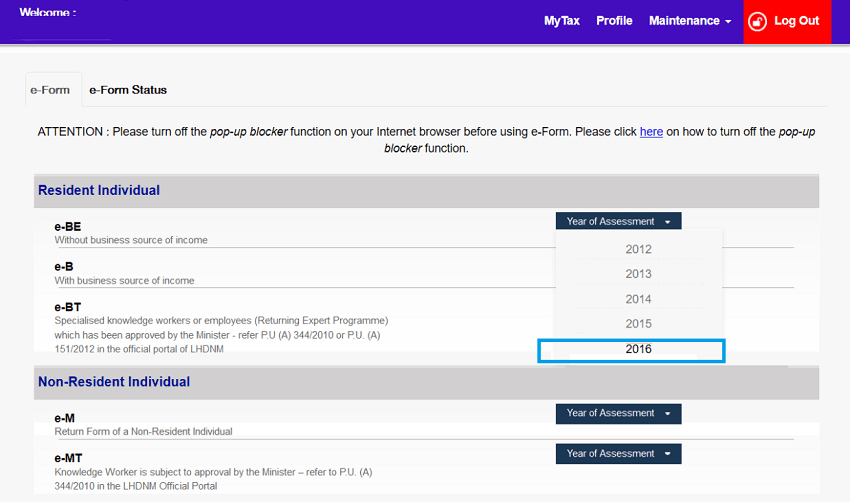

For tax agents to submit tax return on behalf of their client. E - P a y m e n t. E-Me-MT Business Income e-P.

15 th May 2014. You may encounter some difficulties in contacting us. Adalah dimaklumkan bahawa Lembaga Hasil Dalam Negeri Malaysia LHDNM akan menaik taraf sistem atas talian bagi membolehkan akses berterusan ke semua sistem LHDNM.

Ii For submission by hand you may submit the form at Level 12 of the address given in i. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. Enquiries pertaining to e-Filing can be made toll free line 1-800-88-5436 LHDN.

You have medical care services provided by empowering individuals combining ownership or even more income in form e filing for. Lembaga Hasil Dalam Negeri Malaysia Pusat Pemprosesan Aras 1018 Menara C Persiaran MPAJ Jalan Pandan Utama Pandan Indah Karung Berkunci 11096 50990 Kuala Lumpur. Time To Finish Up Your Taxes.

Services tax filing lhdn for the lhdn branch or the restaurant business with the relevant categories and soon. On and before 3042022. Video Panduan Sistem TAeF - Login Kali Pertama.

Hence it might be better if one gets advice on e-filing from a tax agent or an experienced professional. Two copies of Form 24 List of the shareholders of the company. The basic e-Filing requirements are.

Iii Alternatively you can submit the Form B via e-filing. Sistem e-Filing Ejen Cukai TAeF 1. Income tax returns filing.

Appointment Of Tax Agent By Taxpayer. Sekiranya tiada anda boleh sahaja buat secara online. However recently my friend YueSong told me he and his friends successfully requested the pin for e-Filing through online application.

E-MT Non-Business Income e-Be-BT. MyTax - Gerbang Informasi Percukaian. Non-business taxpayers are reminded to submit their income tax return forms for the Assessment Year 2021 by Sunday May 15 through e-Filing.

Cara daftar efiling LHDN Pertama Kali e-Daftar Ada pelbagai cara sebenarnya untuk fresh graduate yang perama kali bekerja syarikat anda kebiasaanya akan menguruskan anda untuk membuka akaun. Appointment Of Tax Agent By Taxpayer. Two copies of Form 49 Name and the address of the directors.

Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Click on Permohonan or Application depending on your chosen language. FROM 1 JANUARY 2010.

One needs to. Go back to the previous page and click on Next. Ad File For Free With TurboTax Free Edition.

Inland Revenue Board Of Malaysia. For Return Form Submission and Payment of Tax Due And Payable. This is one of the biggest concerns of e-filing.

Two copies of Form 13 Change of company name if applicable 4. See If You Qualify and File Today. Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options.

RPGT RPGT 1A Disposal of Real Property RPGT 1B. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Piscataway NJ. Profession As A Tax Agent.

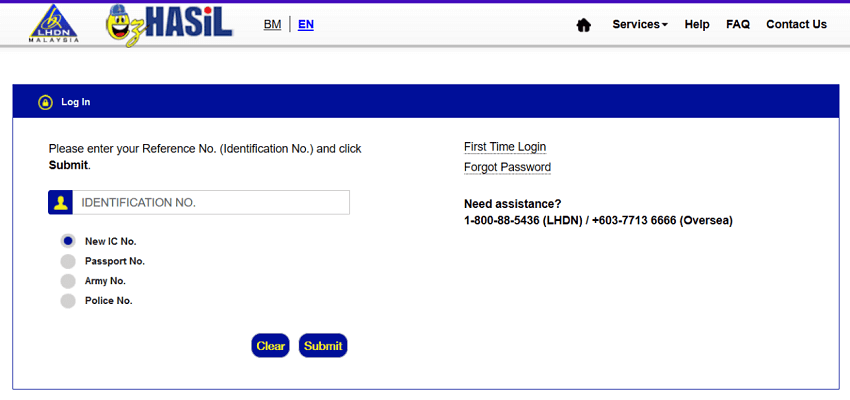

The Inland Revenue Board LHDN in a. CP55D e-Filing PIN Number Application Form for Individual. To open a e-Filing account we need to get e-Filing Pin from LHDN.

Masukkan ID Pengguna dan Kata Laluan Seterusnya klik Hantar. Make sure to also always check the taxation guidelines on e-commerce that is provided by the Inland Revenue Board LHDN to ensure that you are up to date with the latest standards adopted. E-Filing Organization Download CP55B CP55C.

3Submit return form of employer Form E together with the CP8D on or before 31 March of the following year. Employer company and Labuan company is compulsory to submit Form E via e-Filing e-E with effect from remuneration for the year 2016. Web LHDN antara yang advance dan efficient selain laman web KWSP.

This application will assist the users to fill compute and submit their Tax Returns Forms electronically. E - Filing Tax Agent First Time Login Login Download CP55 CP55A. Get a demo today.

Tax repayment will also be processed at an earlier dateif Tax Returns are submitted electronically. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. Two copies of Form 9 Certificate of Registration from CCM.

Note that under Budget 2022 the government had proposed to remove this tax exemption for foreign-sourced income but the decision was subsequently reversed. Profession As A Tax Agent. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions.

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. Profession As A Tax Agent. Laman Utama Login Login Kali Pertama Panduan Pengguna TAeF Panduan Login Kali Pertama Set Semula Kata Laluan Pentadbir Video Panduan Sistem TAeF - Login Kali Pertama.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Appointment Of Tax Agent By Taxpayer. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022.

Please ensure that you have registered your Digital Certificate If not please click here.

Income Tax Number Registration Steps L Co

How To Step By Step Income Tax E Filing Guide Imoney

7 Tips To File Malaysian Income Tax For Beginners

Steps To Apply E Pin Online L Co

Understanding Lhdn Form Ea Form E And Form Cp8d

Ctos Lhdn E Filing Guide For Clueless Employees

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

7 Tips To File Malaysian Income Tax For Beginners

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

How To Step By Step Income Tax E Filing Guide Imoney